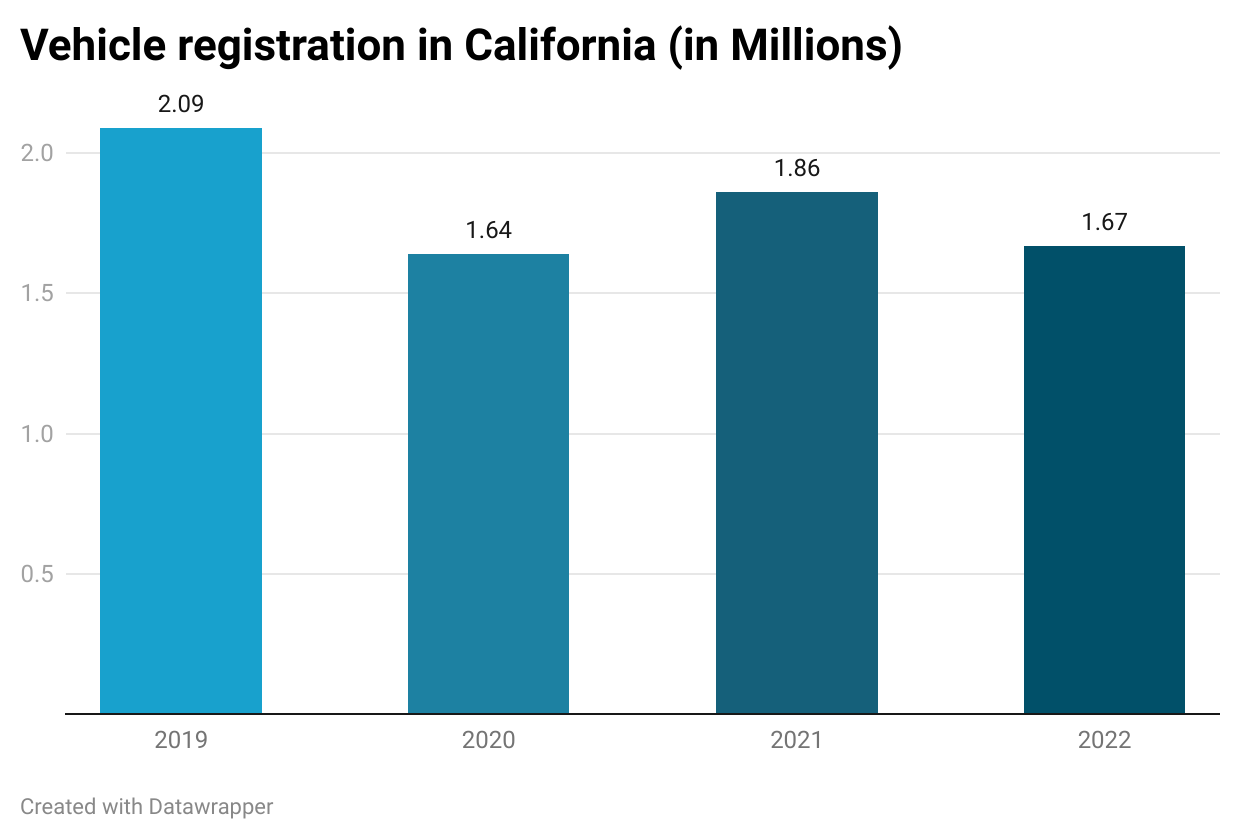

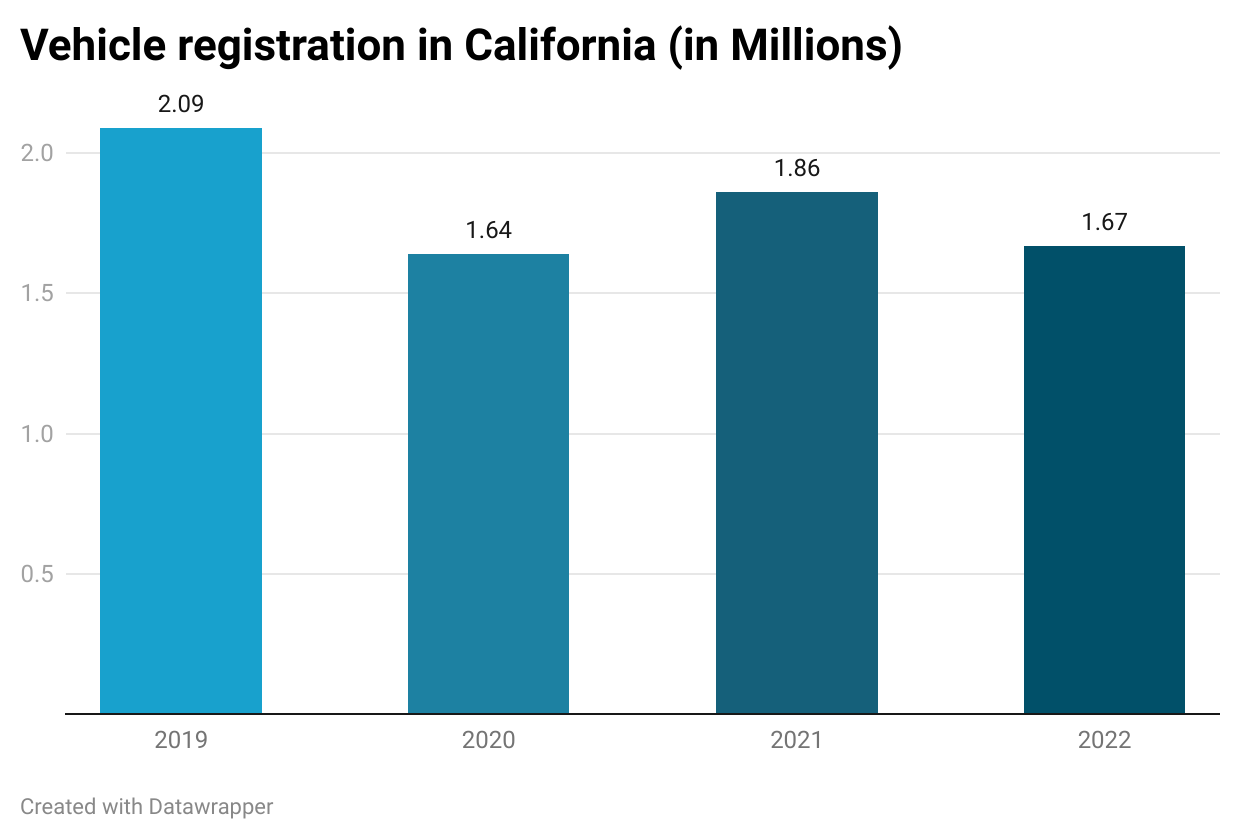

The vehicle market in California has seen a rapid expansion over the past few years. This surge in numbers makes it a necessity for strict laws governing vehicle ownership and the responsibilities that come with it.

At the core of these regulations are the financial responsibility laws. Enforced by the state, these laws mandate individuals to provide evidence of their ability to cover costs if they’re ever involved in an accident. Majorly linked with vehicles, these laws typically manifest in the form of mandatory car insurance coverage. Drivers must carry proof of this insurance in their vehicles at all times.

This article aims to thoroughly explore California’s compulsory financial responsibility law, detailing its components and guiding you on how to stay compliant.

- California’s Compulsory Financial Responsibility Law: What You Need to Know

- Requirements of California’s Financial Responsibility Law

- Alternative Types of Financial Responsibility in California

- Types of Car Insurance Coverage to Carry

- Consequences of Violating California’s Financial Responsibility Law

- Showing Financial Responsibility at the Site of Accident

California’s Compulsory Financial Responsibility Law: What You Need to Know

The Insurance Information Institute reveals that almost every state mandates drivers to possess auto liability insurance to legally operate a motor vehicle. This type of insurance covers the medical expenses, vehicle repairs, and other costs incurred by the other driver when the policyholder is responsible for an accident.

State laws determine the minimum coverage amounts or alternative financial securities drivers need to compensate for damages or injuries caused by their negligence in the event of an accident.

California’s compulsory Financial Responsibility Law is designed to ensure that both drivers and vehicle owners are capable of covering any damages or injuries resulting from traffic accidents, irrespective of who is at fault. The law aims to keep financially irresponsible drivers off the roads.

It applies to anyone who drives a motor vehicle, owns a motor vehicle but does not drive it, or allows others to drive their vehicle. Drivers are required to carry proof of this financial responsibility in their vehicles at all times. This proof must be presented upon request by law enforcement, during vehicle registration renewal, or after being involved in a traffic collision.

If you find it difficult to navigate the legalities of California’s compulsory financial responsibility or have been injured in an accident, contact The Personal Injury Center and we will get you in touch with expert lawyers in your area. Our primary aim is to guarantee that you receive the rightful compensation for your suffering.

Requirements of California’s Financial Responsibility Law

Financial responsibility laws ensure that drivers can account for damages or injuries caused by accidents. Adhering to these laws not only keeps you legal on the road but also safeguards your finances from potential penalties and insurance rate hikes. Especially for drivers in states like California, understanding and meeting these minimum insurance requirements is crucial for a smooth driving experience:

Compliance and Proof

Authorities, such as police officers, may request proof of insurance during traffic stops or following an accident. This check confirms you’re following the financial responsibility law, protecting both you and other road users. These proofs are required at certain points:

- Vehicle Registration: You’ll need to show you’re insured when registering your vehicle.

- License Reinstatement: Proof is also necessary if you’re looking to reinstate your driver’s license.

Support for Low-Income Drivers

Some states, like California, offer support to help low-income residents meet these requirements. Eligible individuals may access more affordable insurance policies, ensuring they can comply without financial strain.

Minimum Liability Insurance Requirements

In California, the law specifies minimum liability insurance amounts for different vehicles. Liability insurance is vital as it covers injuries or damages to others where the policyholder is at fault. Note, however, that comprehensive or collision insurance doesn’t satisfy these financial responsibility requirements. Moreover, commercial and fleet vehicles might have additional requirements set by federal, state, or local agencies.

Alternative Types of Financial Responsibility in California

In California, fulfilling your financial responsibility in the event of a car accident doesn’t stop at having an auto insurance policy. There are three additional methods recognized by the state to prove you’re financially capable, but not every driver qualifies for each option.

Here is a breakdown of what each alternative entails and works:

Cash Deposit

One straightforward method is depositing cash. Here’s how it works:

- Deposit $35,000: You start by depositing $35,000 in a savings account at any bank.

- Notify the DMV: Next, contact the DMV’s Financial Responsibility Unit to submit an application form, proving the deposit.

- Maintain the Balance: Ensure the account always has $35,000. In case you’re at fault in an accident, the DMV will use these funds to cover liability expenses.

Certificate of Self-Insurance

For those owning a large fleet, specifically more than 25 vehicles, the DMV offers a self-insurance certificate. This certificate is your pledge that you’re capable of covering expenses like medical bills, car repairs, and property damage, similar to a standard liability policy. You’ll need to demonstrate to the DMV that you have the financial strength to meet these obligations before receiving the certificate.

Surety Bond

Another option is purchasing a surety bond for $35,000. This bond acts as a guarantee for covering medical expenses, car repairs, and property damage if you’re at fault in an accident.

- How It Works: If you are unable to pay these costs, the surety company will cover them initially. However, be prepared, as the company will then seek reimbursement from you.

- Getting Started: To find a licensed surety company, reach out to the California Department of Insurance for a current list of providers.

Understanding and choosing the right method to comply with California’s financial responsibility laws can be complex. If you’re finding it challenging, The Personal Injury Center is here to help. We connect you with experienced legal professionals in your area to guide you through the process.

Types of Car Insurance Coverage to Carry

Carrying the right amount and type of insurance is crucial for every driver in California. While sticking to the minimum requirements keeps you legal on the road, considering additional or higher coverage can save you from potential financial hardships in the event of an accident. Always review your policy options carefully and consider your assets and personal risk when choosing your coverage limits.

Liability Coverage

Liability Coverage is designed to compensate for bodily injuries or property damages resulting from a traffic accident for which you are responsible. The minimum requirements that drivers must carry in California include:

- Bodily Injury Liability Insurance: At least $15,000 per person and $30,000 per accident. This covers the medical expenses of the other party if you’re at fault.

- Property Damage Liability Insurance: In the event you’re at wrong in an accident, you are responsible for covering the costs of repairs to the other party’s vehicle, up to $5,000 per accident.

Important Clarifications

- Comprehensive and Collision Insurance: It’s crucial to note that comprehensive or collision insurance, along with medical payments (med pay) insurance, does not meet California’s mandatory insurance requirements.

- Uninsured/Underinsured Motorist Coverage: While highly beneficial, carrying uninsured or underinsured motorist (UM/IM) coverage is not a legal requirement in California.

Consider Higher Coverage Limits

The state’s minimum liability limits may not suffice to cover all medical expenses or damages to another vehicle in an accident where you’re at fault. Often, the minimum coverage won’t cover the full extent of the costs, leaving you to pay the difference. Opting for higher limits is a wise choice to protect your assets and avoid financial strain post-accident.

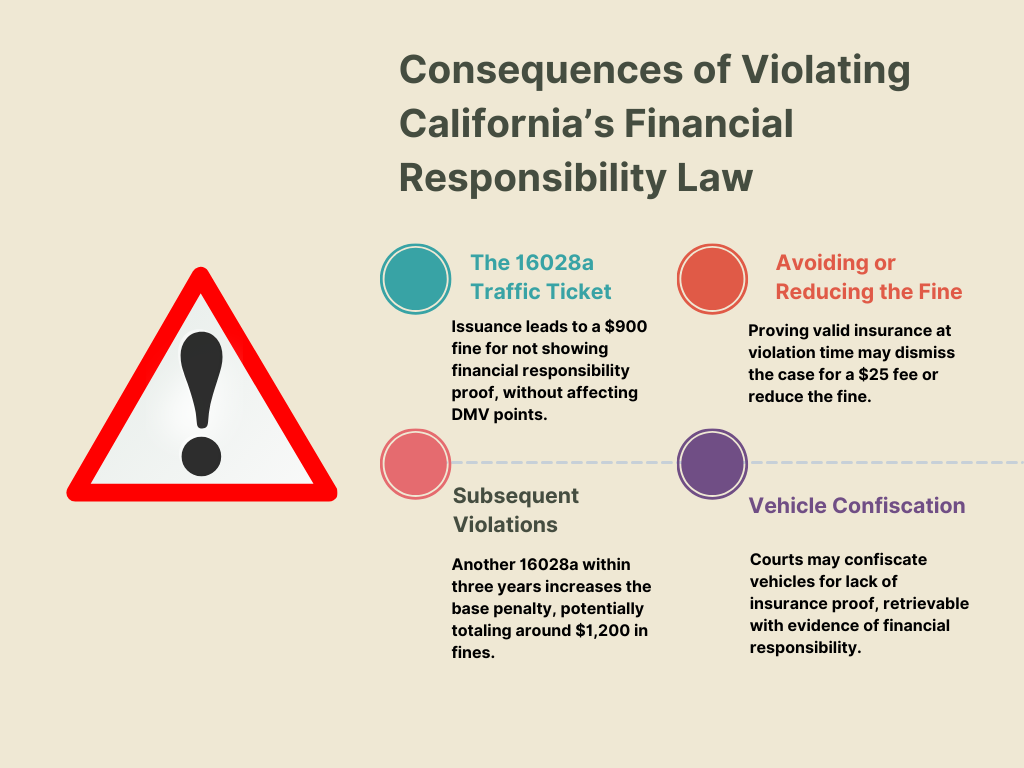

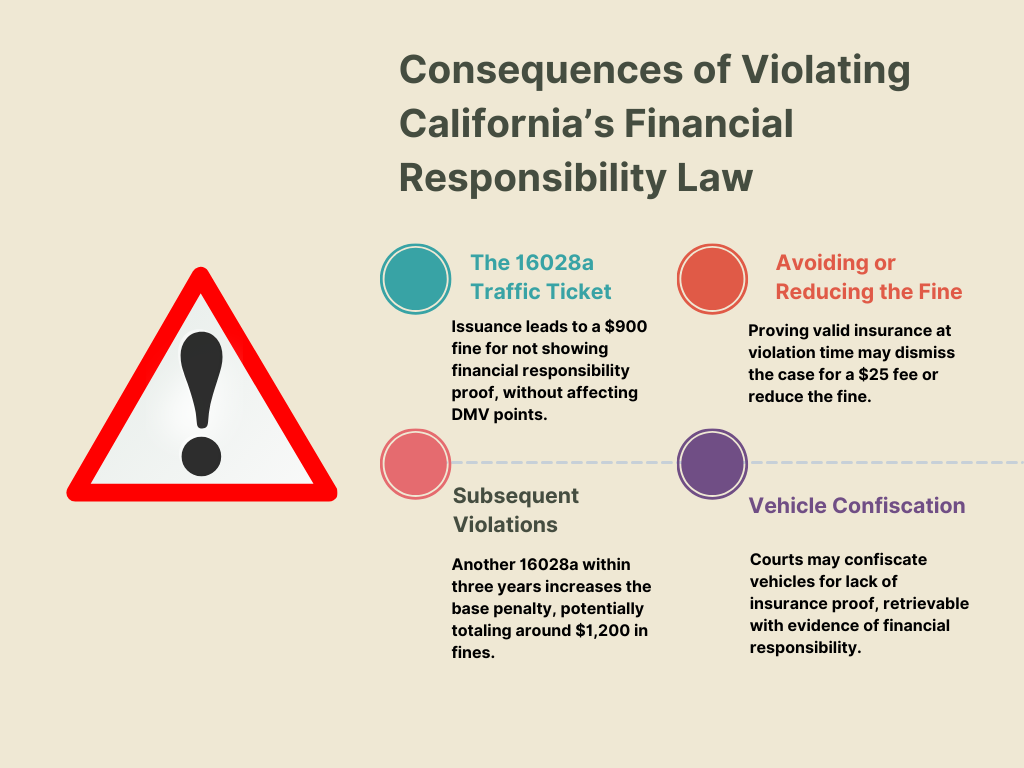

Consequences of Violating California’s Financial Responsibility Law

In California, failing to show proof of insurance to a law enforcement officer when requested can lead to significant penalties under Vehicle Code 16028a. Here’s what you need to know about the consequences of such a violation and how you can manage the situation.

The 16028a Traffic Ticket

- Issuance: If you’re unable to provide evidence of financial responsibility during a traffic stop, the officer will issue a ticket under Vehicle Code 16028a.

- Fine Details: A 16028a ticket comes with a heavy $900 fine. This includes a base fine of $100 to $200, plus additional penalty assessments. Notably, this violation does not add points to your DMV record.

Avoiding or Reducing the Fine

- Proof of Insurance: If you can prove that you had valid automobile liability insurance at the time of the violation, the court may dismiss the case for a minimal $25 administrative fee.

- Acquiring Insurance Post-Violation: Should you obtain proper insurance coverage shortly after the violation, there’s a possibility the fine could be reduced, or the charge might be dismissed entirely.

Subsequent Violations

- Increased Penalties: If you receive another 16028a ticket within three years, it’s still considered an infraction but with a higher base penalty ranging from $200 to $500. With penalty assessments, the total fine can reach approximately $1,200.

- Vehicle Confiscation: The court may also confiscate your vehicle for failing to provide insurance information, though it requires showing “good cause.” You can retrieve your car by presenting proof of financial responsibility.

Showing Financial Responsibility at the Site of Accident

Being involved in a traffic accident can be stressful, especially if it falls under what’s termed a “reportable” accident. This includes any incidents with property damage over $1,000, any injuries, or fatalities. If your vehicle is part of such an incident, California law mandates you to show proof of insurance to either the involved parties or a police officer. Here’s a straightforward guide on what happens if your vehicle isn’t insured at the time of the accident and how you can navigate the aftermath:

- No Immediate Arrest: If your vehicle was uninsured during a reportable accident, rest assured, you won’t be arrested.

- DMV Notification: The California Department of Motor Vehicles (DMV) will likely find out about the lack of insurance through various channels:

- Another party involved in filing an SR-1 Form with the DMV.

- An insurance company reporting the uninsured incident following the accident.

- A law enforcement officer reporting to the DMV that you lacked valid insurance during the accident.

- The DMV’s Response: The DMV initiates a process to suspend your driver’s license. This process starts immediately upon notification and doesn’t pause for further evidence. You’ll receive a “Notice of Suspension/Revocation” at your last known address, signaling the start of the suspension process. Importantly, this notice also extends an opportunity for you to request an administrative hearing to contest the suspension.

- Seeking Professional Help: Navigating the DMV’s process can be complex. However, seeking legal help can make it smoother.

- Expert Guidance: Tackling the DMV’s procedures and ensuring your best interests are represented requires expertise. The complexity of the process highlights the value of having a knowledgeable advocate on your side.

If you’ve sustained injuries in an accident caused by another party, reach out to The Personal Injury Center. We will connect you with skilled attorneys in your vicinity. Our primary aim is to guarantee that you receive the rightful compensation for your suffering.

Key Takeaways

|